Active vs. Passive: Want to know what style is good for you?

When investing in the financial markets, one crucial decision we all need to make is choosing between active and passive management funds. Understanding the

When investing in the financial markets, one crucial decision we all need to make is choosing between active and passive management funds. Understanding the

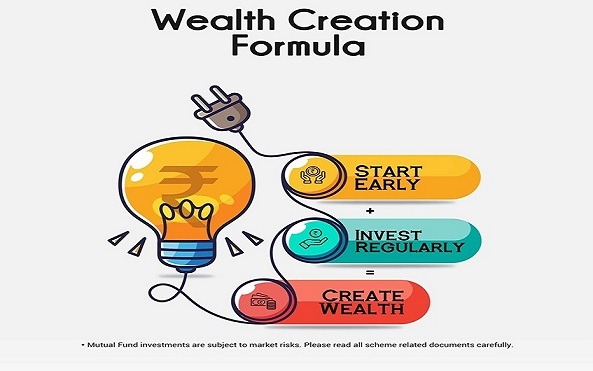

Many investors wonder how mutual funds returns are achieved, and how the power of compounding in mutual funds plays a major role. When discussing mutual

This is that time of the year, 1st of December every year, when I reach out on my work anniversary. I share my perspectives on

Retire how you want, not how others want you to! Have you been struggling to maintain a work-life balance? Are you working just to

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early

It’s easy to get caught up in the rat race and forget to enjoy life. However, it is important to consider, how much money

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year,

Yes, It is possible to get low-cost, high-quality health insurance plans. This blog is dedicated to guide you on this.

Some people have spent a significant amount of money on extremely expensive high-coverage health insurance. You can still obtain the same level of protection for a fraction of the price. Let’s take it step by step to understand it.

7 ‘Wants’ management tips for Effective financial health “If you buy things you DO NOT NEED, soon you will have to sell things that you

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year,