Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2021, I am happy to share that I am completing 5 years since I set up Financial Radiance, after working in the corporate sector in finance and technology for over 21 years!.

My Journey at Financial Radiance

I moved into the business of distribution of financial products to follow my passion. Like with foray into any practice, this also had a fat share of both ups and downs like changes in regulation, Covid-19 outbreak when the markets tanked and the subsequent rebound, etc. But overall, when I look back, it has been immensely satisfying considering the handholding opportunity which I had in helping my clients navigate through the same, helping them make the correct decisions for their future quest into achieving their goals and objectives and working towards financial freedom.

The Assets Under Management (AUM) increased sharply since the Covid-break more than doubling over the period. I am pleased to inform you that I am working with more than 250 clients, managing a cumulative AUM of about Rs 65 crores with a Systematic Investment Plan (SIP) book of over Rs 60 lakhs a month. This is in addition to term insurance of sum assured of about Rs 85 crores. When I started five years back, I had not imagined that the growth would happen so quickly. That too when the portfolio is largely very retail focus with clients both in India and abroad. This gets me a lot of satisfaction at the end of the day, having helped my clients navigate through the financial markets’ vagaries, whims, and fancies.

Helping them to stay focused on their goals and keep their investments based on time horizon, risk appetite, and objectives. Thank you, dear investors, family members, and friends for your trust. It has been indeed been a very humbling experience working with all of you.

Covid-19 and its after effects

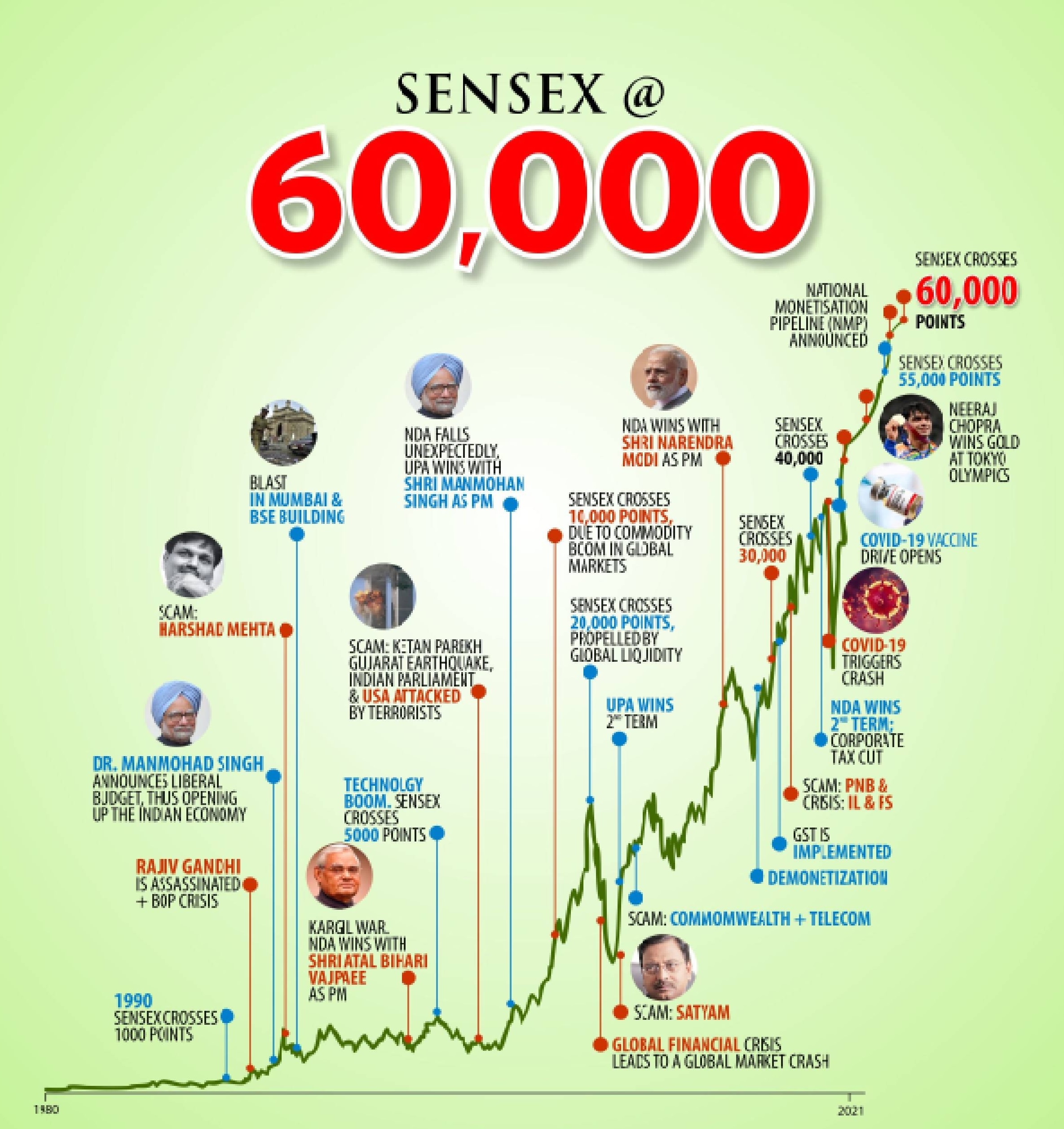

When the lockdown was abruptly announced last year, there was no impact on the day-to-day operations of the business. The decision which I had taken while setting up the practice of going completely digital helped me significantly during those tough times. At the time, when otherwise transacting through the offline process was not possible, I had no issues in getting the purchases and the redemptions are done for my clients. The markets fell more than 50% in a short span. For some of the clients who were investing for the first time were nervous and I was fortunate to handhold them explaining that it was indeed a good time for investing for their long-term goals. I explained that their investments through the systematic route should continue and if possible, increase, as this was a “SALE” happening in the markets, which happens once in a while. Markets were down to the Sensex levels at around 25,000. It needs a lot of patience, perseverance, and determination not to panic and not take any action on current investments… Like the famous Cadbury advertisement these days “achcha hua tumne kuch nahin kiya”. Those who just did that (not doing anything), have seen wealth going up significantly over a short period again with the markets now being close to 60,000 levels. While those days too, there were people who were skeptical to invest waiting for the markets to fall to about 8,000, the levels achieved during the 2008 financial crisis. The reality is that they may continue to wait forever sitting on the sidelines since the overall trajectory of the markets is always up. Sensex started with a base of 100 in 1978-79. We had all sorts of crises and the roller coaster ride since then but the trajectory will always be Up. There are talks of Sensex going beyond 100,000. That will happen one day for sure, when is what we do not know. The crux in personal finance investing is that more than timing, it is in the time in the market which is most important.

In-depth research of Mutual Funds

Since Mutual Fund investments are one of the most important activities which we do, we decided to strengthen our internal research on the various funds which are available in the market. There are more than 3000 funds in the industry spread across about 45 Asset Management Companies (AMCs) and 37 categories as prescribed by SEBI. There is a need to do in-depth research on various parameters like AMC history, investment management process, fund objectives, past performance, short term, and long term, risk ratios, and a lot of other factors. We decided to do this in-depth research every 6 months which could us make the best decisions for our clients. The access to product heads and fund managers in these AMCs also helps us in asking the right questions and identifying the best products for our clients. While investments are done with a long-term perspective in mind, this in-depth research helps us in making any mid-way changes, if needed.

Products & Services tie-ups

Over the past five years, we have done the tie-ups with various products and services providers to offer a one-place convenience and experience to my clients. While there are some services like mutual funds, term insurance, health insurance, and capital gains bonds wherein we get involved directly and help clients choose the best product, there are few services like Global investing, old investments, and tax filing, wherein we rely on the experts and get them connected. You can get more details about various services at Services – Financial Radiance.

My Wealth Protector – a new tie-up

I am very excited to talk about a new tie-up which I did last year with My Wealth Protector. I truly believe that even the best of plans can be jeopardized due to unforeseen events. What if there is ‘Sudden Death’ of the earning member of a family? Our sole objective is that no spouse & children should be deprived of their rightful inheritance in the eventuality where the earning member is no more. This was my rationale when I approached My Wealth Protector for a tie-up that can immensely help my clients. They have two products: My E-Vault which is a free App and Beyond life services which is a paid subscription. Me E-vault digitizes and organizes the various financial assets. What is the point of acquiring assets if your loved ones do not know about them? I urge everyone to download the App and experience it. The other service which is chargeable is the Beyond life services, wherein in case of the untimely death of the member, a relationship manager gets assigned by My Wealth Protector who works very closely with the dependents, getting the onerous forms filled for all the various products, handholding along with the way and getting the transmission completed. I view this as something similar to the term insurance, wherein you keep paying the subscription fees every year, not expecting any returns out of it. But in case of untimely death, the surviving family members who would be coping up with the emotional stress, do not need to worry about at least the transmission aspects of various assets. The annual plan is available for Rs 1,499 while a 5 years plan is for Rs 5,999. What’s more, if you decide to subscribe from my website providing the mentioned coupon code, you get a flat 30% discount. Do check out more details at: Beyond Life Services.

Regrets in this profession

The last five years have been immensely satisfying as I see my role as a catalyst helping people achieve financial freedom. We all have done various mistakes relating to personal finance, whether it could be not starting early, investing in a wrong product, not investing based on goals and objectives, etc. At the end of the day, I get the satisfaction of having helped people avoid certain mistakes which perhaps I had also done early in my career when I had not reached someone who has the expertise in the same. However, there are certain regrets too in this profession. I know that some of my clients may not be able to achieve some of their goals or maybe not to the extent they would have liked. This could be due to various reasons like continuing to have a myopic view when considering personal finance investments. Reasons could be many, like exiting out of the investments too early, getting panicky and exiting from investments during the bear phase, not remaining invested for the goals originally discussed, getting sold a product by someone who is not aligned to their objectives, etc. But, life must go on and as I said, I can only be a catalyst but not the decision-maker……

My Relocation

Last year, I also had a big change on the personal front. After staying in South India for 21 years (mainly Hyderabad where we stayed for 15 years), as a family we decided to move to Greater Noida in North India so that we could be closer to our family which we believe also needs our focus and attention. The decision was taken at the start of the practice of implementing various investments completely online helped in this transition with no impact on any of my clients. About half of my clientele is based out of Hyderabad, while the rest is all over the World. The pandemic has also taught us that work can transcend geographical boundaries if technology is embraced and adopted. This has been something which I have always been passionate about, thanks to my techno-functional corporate career over two decades in the past. I would like to take a moment to thank all my investors who stood by me when I discussed with them my personal decision to relocate from Hyderabad.

Before, I sign-off last few things:

Personal Finance Toolkit – I created this toolkit which is available free to download. Using this toolkit would help in determining the net worth and the various documentation relating to personal finance in one single place. Do download it and let me know your feedback.

Link to previous year’s perspectives – I have been writing my perspectives on completing every year at Financial Radiance. Do read them in your leisure. I am sure you will enjoy them as much as I do while working for Financial Radiance.

Blogs on Personal Finance – I have written quite a few blogs on various diverse personal finance topics. Please do have a look and provide your comments.

- Youtube Channel – Please watch my youtube channel and subscribe.

Until next year, bye from me, and I shall be back with my perspective on completing 6 years at Financial Radiance.