Introduction

According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages.

Why should it be any different for investing? One popular way of building Wealth over a long period of investing is by investing in Mutual Funds through the Systematic Investment Plans (SIP) route.

How do Mutual Funds Work?

What mutual funds do is that they collect money from investors and invest this pool of funds to achieve a common investment objective. This is the primary reason why several investors are switching from conservative investment options like gold, FDs and PPFs to mutual fund schemes. Mutual funds do carry investment risk, but long term investing is known to reduce overall investment risk and optimise capital appreciation. Ideally, one must keep an investment horizon of at least 10 to 15 years. The longer the better!

Advantages of starting SIP early

Starting your SIPs early comes with a lot of advantages:

- Longer time for investing: The most obvious is that you have a longer time to save and invest for your goals. This means that if you start early, you can accomplish the same goals with much smaller amounts.

- Getting into the habit: The second advantage is that when you start your SIPs early, you get into the habit of saving early. As you grow older, this habit only deepens its roots, making you a star saver and investor.

- Fewer responsibilities, so more investing: Another advantage is that since at a young age, you have fewer responsibilities, you can direct more money to investments than you can if you are in your thirties, are married and have children.

Other benefits of SIP at an early age :

- No huge Initial Investment: As mentioned earlier, lower investment monthly would help in achieving the Goal.

- Power of Compounding: Corpus may grow exponentially rather than linearly. An example it given later to show the power of compounding.

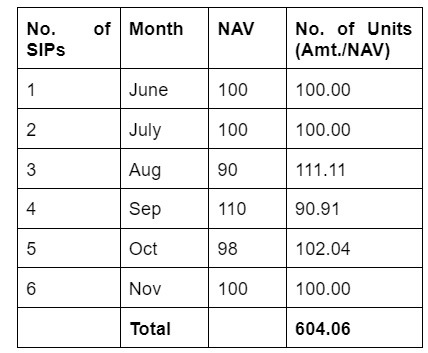

- Cost Averaging: Let us understand this with an example: Nidhi invests Rs 10,000 each month in a SIP of an equity mutual fund. Say, the markets are volatile for a particular period. Her investments would look like below.

The average NAV cost per unit by rupee cost averaging comes lower to Rs 99.33 (Rs 60,000/604.06) instead of Rs 100. Further, if Nidhi does not choose the SIP method and would have made a lump sum investment instead, then her number of units in June would have been 600 (Rs 60,000/Rs 100) according to the NAV of June. It is extremely difficult to time the markets and therefore, SIP works out a better way while investing. Secondly, when markets fall, instead of panicking and taking an irrational decision of making a redemption, it is indeed a good time to invest, since we get more units at the same cost. Don’t we all get excited and Shop during a Sale! So, why do it differently while investing?

So, summarising the benefits, starting an SIP at an early age can help you build long-term wealth, achieve your financial goals, and develop the habit of disciplined savings.

Let’s have an example to understand its power. Assuming a person will keep investing Rs 30,000 per month till 60 yrs of age and assuming an average annual returns @ 12% p.a.

Starting Age (Years) | Investment Tenure (Years) | Fixed Rs 30,000 monthly investment | 10% step up every year | Difference in amount Fixed v/s Step up (Rs crore) | ||

Total invested amount | Estimated portfolio value | Total invested amount | Estimated portfolio value | |||

25 | 35 | 1,26,00,000 | 16,53,24,934 | 9,75,68,773 | 47,29,44,798 | 30.8 |

30 | 30 | 1,08,00,000 | 9,24,29,196 | 5,92,17,848 | 23,95,73,288 | 14.7 |

35 | 25 | 90,00,000 | 5,10,66,197 | 3,54,04,941 | 11,80,65,054 | 6.7 |

40 | 20 | 72,00,000 | 2,75,95,721 | 2,06,19,000 | 5,58,94,150 | 2.8 |

45 | 15 | 54,00,000 | 1,42,77,942 | 1,14,38,093 | 2,48,24,154 | 1.1 |

Important Observations

- A delay of just 5 years in starting investment, starting the investments at the age of 30 years instead of starting at the age of 25 years, reduces the portfolio value by a staggering Rs 7.3 crores and by Rs 24.3 crores (with a 10% step up). The amount not invested was just Rs 18 lakhs. That’s the power of compounding!

As per the above example, if you were to start investing at age 45 years, instead of 25 years, you have lost the track already, as your corpus at the age of 60 years would be just 5% of the value if you had started at the age of 25 years. Don’t worry about how much you can start investing with, but get the discipline of investing early and regularly, and then keep increasing the investments as and when the cash flows allow.

- An increase of 10% in the SIP amount every year is resulting in a huge increase of more than Rs 30 Crores if you were to start investing with Rs 30,000 per month at the age of 25 years.

4 Concepts in Early Investing

In summary, here are the four concepts which we discussed in early investing:

- Cost averaging through Systematic investing – Investing a fixed amount every month, rather than trying to time the market. Also brings in discipline in investing.

- Power of compounding – Wealth gets built up much faster towards the latter part of investing. Compounding is the 8th Wonder of the World.

- Step up investing – Keep increasing investments with increase in income. Lifestyle expenses and aspirations do grow, but keeping a watch on investments and increasing them is also important.

- Cost of delay – A delay of just a few years in investments impacts big time over a long period. Just because the amount available for investing is less when we start working should not be an excuse for not investing at all.

More blogs to read

If you have got excited reading this blog and are all set to get started with investing, but wondering how to do and where to invest, then I have already written a few blogs on this topic in the past and I am referencing them below for quick access.

- 6 logical ways to increase net worth

- Debt trap: 4 warning signals to check if we are falling into it

- 16 simple ideas to start wealth creation and build net worth

- What are SIP myths? Here are 7 of them that are busted

- 7 ‘Wants’ management tips for Effective financial health

If you would like to read more such blogs then please visit our website. If you would like to avail of any of our services and want to get started with investing, then please contact us. You can also set up a free 30 mins meeting with me if you would like to have any specific discussion.investing strategies early investment financial planning wealth creation