Active vs. Passive: Want to know what style is good for you?

When investing in the financial markets, one crucial decision we all need to make is choosing between active and passive management funds. Understanding the differences between these two approaches is essential for making informed investment decisions. Let’s explore and understand the characteristics and importance of choosing between active and passive management funds, which helps […]

Why power of compounding is 8th Wonder of the World!

Many investors wonder how mutual funds returns are achieved, and how the power of compounding in mutual funds plays a major role. When discussing mutual funds, the primary consideration is often the potential for returns over the long term. To explore this concept further, let us start with a story. In a busy city, Alex […]

Start Small, Grow Big: 4 Concepts on how Early Investing can make a Difference!

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages. Why should it be any different for investing? One popular way of building Wealth over a long period of […]

NRI Investors – Should you invest in India – why and how?

NRI Investors – Should you invest in India – why and how? In one of my previous blogs, I provided basic definitions of who is a Non-Resident Indian (NRI), Resident & Not Ordinary Resident (RNOR), Resident Indian (RI), Person of Indian Origin (PIO), and Overseas Citizenship of India (OCI). I also mentioned about differences in NRI […]

12 tips to identify best mutual funds for investing

Best mutual funds to invest? 12 analysis tips If you are new to Mutual Funds, then you may first want to read my previous blog on Mutual Funds Categories. Searching for the best Mutual Funds for investment?: 12 points to look for (and not overlook!) Chasing the best mutual funds for investing? Don’t judge […]

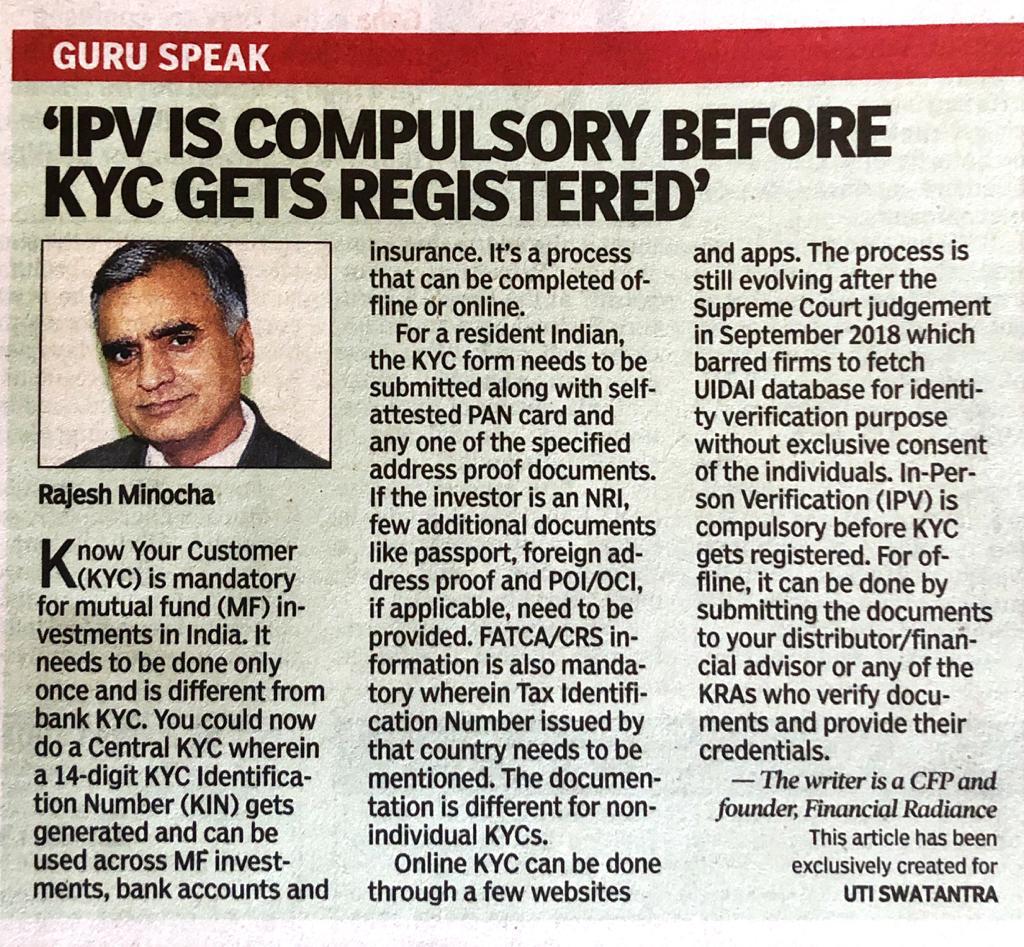

What is KYC (Know your Customer) – Times of India – 19Jan2020

Times of India – 19Jan2020 – Know Your Customer (KYC) Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp