This is that time of the year, 1st of December every year, when I reach out on my work anniversary. I share my perspectives on the year gone by, hits and misses, updates and the learnings during the year. It is very hard to believe that seven years have passed since I started this practice of helping my clients achieve financial freedom. I am indeed very honoured to have many clients who have been with me since the beginning when I started Financial Radiance on December 1, 2016.

A lot of developments have happened during the last year and therefore let me get started.

Reaching Rs 100 crore milestone

We reached the milestone of Rs 100 crore Asset Under Management (AUM) in early June. It is a very significant milestone in our industry. From now onwards, the processes followed by us will also be audited. This would make the organisation even stronger. As of writing this note, Financial Radiance has an AUM of about Rs 125 crore with a SIP book of about Rs 1.2 crore a month. Financial Radiance works with over 325 families across the World. We help our clients achieve financial freedom, through suitable investments. Thank you, investors, for your trust!

My Debut as an author

I had been considering authoring a Book for a long time since I started the practice. This finally got ticked off my bucket list in June this year. My birthday month this year was indeed very eventful. First on crossing the Rs 100 crore AUM mark and then the release of my Book, “Retire on your terms”. The Book starts with my story of how I planned my financial freedom to quit corporate life at the age of 45 years. I now follow my passion on my terms. If I could do it, then anybody can!

This book focuses more on the non-financial aspects of retirement, like how to plan for the same, a retirement checklist and what to do post-retirement. The Book also covers the pros and cons of early retirement, mistakes that people make during retirement, and a lot more. If you have not read my book yet, then I strongly urge you to pick it up on Amazon or elsewhere. The Book is available on Amazon Globally. Here is the link for Amazon India: https://amzn.to/46hwYlU.

My Book, Retire on your terms, also gave me an opportunity to meet up with leading personalities. Here are some of them who I met and it was a great discussion with them on retirement and other topics. Writing the Book has given me a lot of visibility and an opportunity to get my ideas shared with readers across the World and not just my clients. The Book has been doing very well and Amazon has given it a best-seller tag in India. The Book at one point in time had an all-time high rank of 1357 across all books. It has been great getting feedback about my book from the readers. If you have read the book but have not yet provided the feedback on Amazon, then please provide the same.

Investment Reporting & Customer Management Software

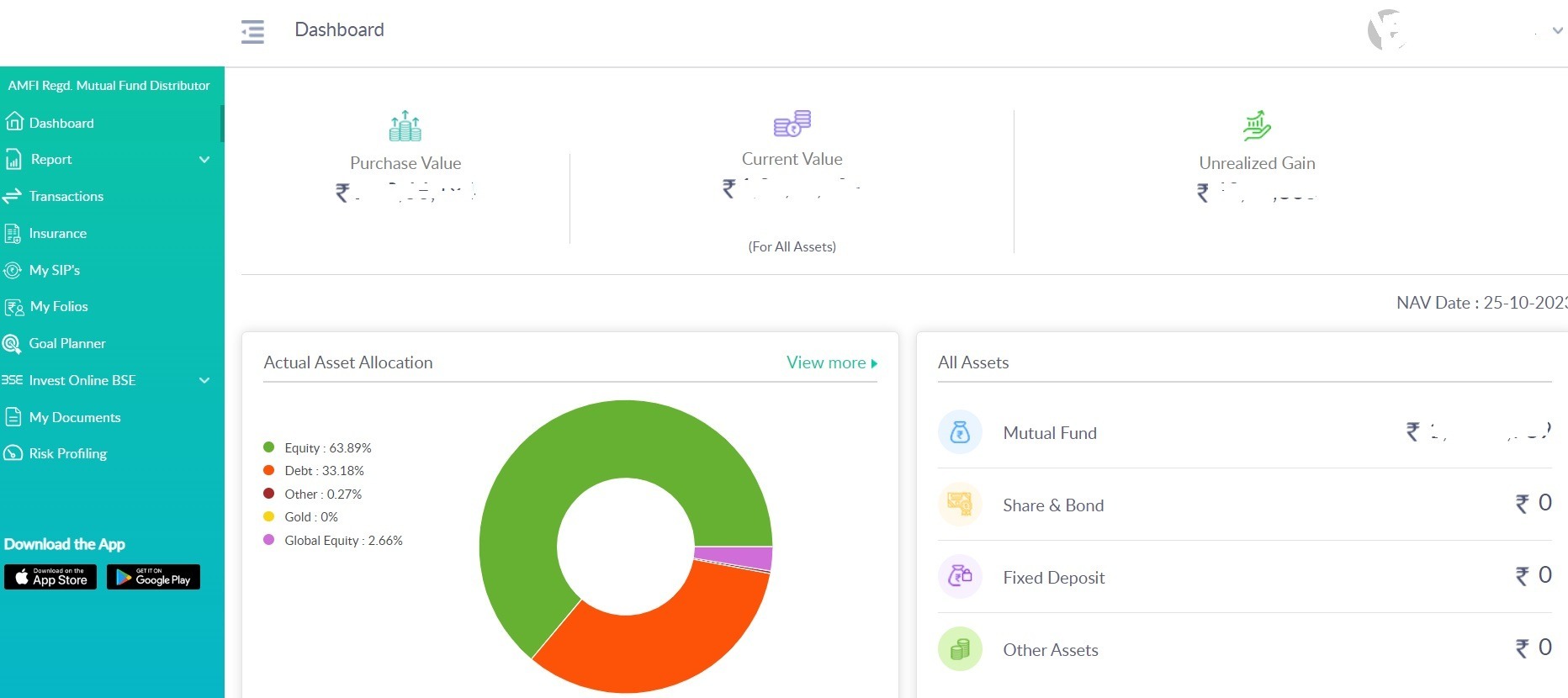

In my update last year, I mentioned that I am considering purchasing the license for state-of-the-art software that will take the data reporting and customer management information to a much higher level. I am happy to inform you that both have been completed.

-

Purchase of Investwell Software license

Investwell is the best software in the industry for tracking investment reporting. It is an expensive license and earlier it was not affordable to me. Now, with the growth and stabilisation of the practice, this license has been purchased to add more value to the clients. It can not only include mutual funds data, but the goals of the investor can also be mapped to other financial and non-financial assets. Also, this can be a one-stop personal finance information database with insurance and other data. This also helps me stay on top of the compliance-related updates that happen regularly. Non-compliance reports can be run easily and appropriate actions can be taken.

-

Customer Relationship Management (CRM)

As practice grows, it is important to streamline the data, so that process-related leaks do not happen in the system. To address this issue, a CRM software license from Masterstroke has been purchased, so that the practice is run professionally. As and when employees are hired in the future, such a system will be of immense usage. Also, with the audit coming up this year, this is a welcome step in that direction.

Setup of a Partnership firm

There have been discussions in the past on the succession planning for Financial Radiance.

In my last update, I mentioned that I am considering a partnership firm to address the issue. Partners can join and exit, but the partnership firm continues. The firm, Financial Radiance, has been constituted and all new onboarding of clients is not happening in the firm. Gradually, the entire practice will be run under the partnership firm.

Created dollar millionaires and rupee crorepatis

Last year, in my blog, I mentioned my vision. The vision is to create 50 dollar millionaires and 200 crorepatis (rupee-denominated) during the course of my entire journey. I track these metrics on a regular basis. As of date, it is 1 dollar millionaire and 34 rupee-denominated crorepatis. The numbers may seem less at this point in time, but I am confident that the vision will exceed the expectations in the years to come. You would agree that investing is long-term and over the years compounding happens big time in the future. So, as long as investors believe in the same and stay put based on their goals, wealth is bound to be generated.

Market vision and outlook

While I am not a forecaster of the future (and this is also not my role), I do have very strong beliefs about the future of India. I do know that India will be a 5 trillion economy in the very near future and will be a country to reckon with during our lifetime. The growth in this decade and in the future will be unimaginable and it is therefore very important not to miss the investing journey during these times. Of course, there will be volatility, as it has been in the past too. Some of the drivers for volatility will be the elections coming up next year, as well as how the other countries perform, oil prices, inflation, and interest rates, and also the fate of the two major wars that are currently happening. It will be important to remain focused and stick to the basics – stay invested for long-term goals in equity, without considering short-term volatility, maintain asset allocation, and keep short-term money requirements in debt or in the balanced type of funds.

Thank you all once again for your faith and trust. As always, before I sign-off for now, a few reminders:

Personal Finance Toolkit – I created this toolkit which is available free to download. Using this toolkit would help in determining the net worth and the various documentation relating to personal finance in one single place. Do download it and let me know your feedback.

Link to previous year’s perspectives – I have been writing my perspectives on completing every year at Financial Radiance. Do read them in your leisure. I am sure you will enjoy them as much as I do while working for Financial Radiance.

Blogs on Personal Finance – I have written quite a few blogs on various diverse personal finance topics. Please do have a look and provide your comments.

- Youtube Channel – Please watch my youtube channel and subscribe.

Until next year, bye from me, and I shall be back with my perspective on completing 8 years at Financial Radiance.