5 Reasons why too much money in bank is bad and what you should do

5 Reasons why too much money in bank is bad and what you should do This is an important topic for discussion and therefore I decided to dedicate a separate blog for it. According to me, this is one of the biggest mistakes done by a lot of people wherein they just let the money […]

NRI Investors – Should you invest in India – why and how?

NRI Investors – Should you invest in India – why and how? In one of my previous blogs, I provided basic definitions of who is a Non-Resident Indian (NRI), Resident & Not Ordinary Resident (RNOR), Resident Indian (RI), Person of Indian Origin (PIO), and Overseas Citizenship of India (OCI). I also mentioned about differences in NRI […]

12 tips to identify best mutual funds for investing

Best mutual funds to invest? 12 analysis tips If you are new to Mutual Funds, then you may first want to read my previous blog on Mutual Funds Categories. Searching for the best Mutual Funds for investment?: 12 points to look for (and not overlook!) Chasing the best mutual funds for investing? Don’t judge […]

Anticipating Job loss? 6 Actions Items Before and After!

Anticipating Job loss? 6 Actions Items Before and After! Current situation We are going through unprecedented times like never before with the Covid-19 situation and the news about job losses. Unlike the influenza flu which had happened in Spain a century ago, this time it is different. The impact of Covid is Global. India took […]

Financial Documentation – Let’s do it now! FREE template

Financial Documentation – Let’s do it now! FREE template During such a turbulent and uncertain time during Covid-19, let us get our financial planning in order. We could utilise this time towards doing something very important which most of us have been neglecting and procrastinating, that is, getting our financial documentation in order and setting […]

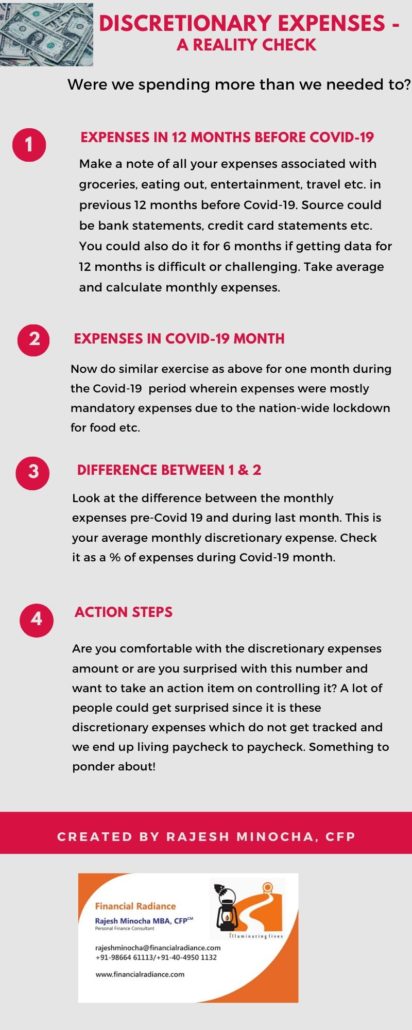

Discretionary expenses – A Reality check

Discretionary expenses– A Reality check Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

What is KYC (Know your Customer) – Times of India – 19Jan2020

Times of India – 19Jan2020 – Know Your Customer (KYC) Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

Personalized financial advice: 6 reasons why it is different

Why is financial advice personalized? Last week, I had written a blog on why we need a financial planner. This week, it is a follow-up on the same topic wherein I present my thoughts on why financial advice is personalized and why one size does not fit all. Financial illiteracy in schools and colleges: This […]

Why do I need Financial Planner when I know how to invest

Why do we need a Financial Planner? This is a very sensitive and a commonly discussed topic amongst personal finance groups. What is the value of what a financial planner or the financial advisor or the financial coach (whatever name they are called), brings to the table. I would like to put some of my […]

Financial Stress: Try the 7 ways in which it can be reduced

Financial Stress – Is it that bad? What is Financial stress? When you keep thinking about money (or the lack of it) even when you are doing an activity which you enjoy. One study concludes that financial stress can increase risk of heart attack by 13% and therefore it is critical for everyone to work […]

3 reasons why personal finance for women is critical

3 reasons why personal finance for women is critical My write up today has been prioritized and is being published out-of-turn (though definitely not out of place) since we have International Women’s day coming up on 8th March. One would argue why does it need a dedicated separate section in personal finance. I think it […]

6 logical ways to increase net worth

Boosting Your Financial Net Worth In one of my previous blogs, I mentioned about ways in which we can stop living a life paycheck to paycheck. One component to do so is how we smartly manage our assets and income. This can be tracked by our networth which is simply the total of all your […]

Living a life paycheck to paycheck?

Living a life paycheck to paycheck – Financial Planning Moving away from comfort zone I have been asked this question a number of times since I left the corporate life – Why did I leave a cushion high paying job to start on my own with an unpredictable income stream and so much uncertainty considering […]