Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2022, I am happy to share that I am completing 6 years since I set up Financial Radiance, after working in the corporate sector in finance and technology for over 21 years!.

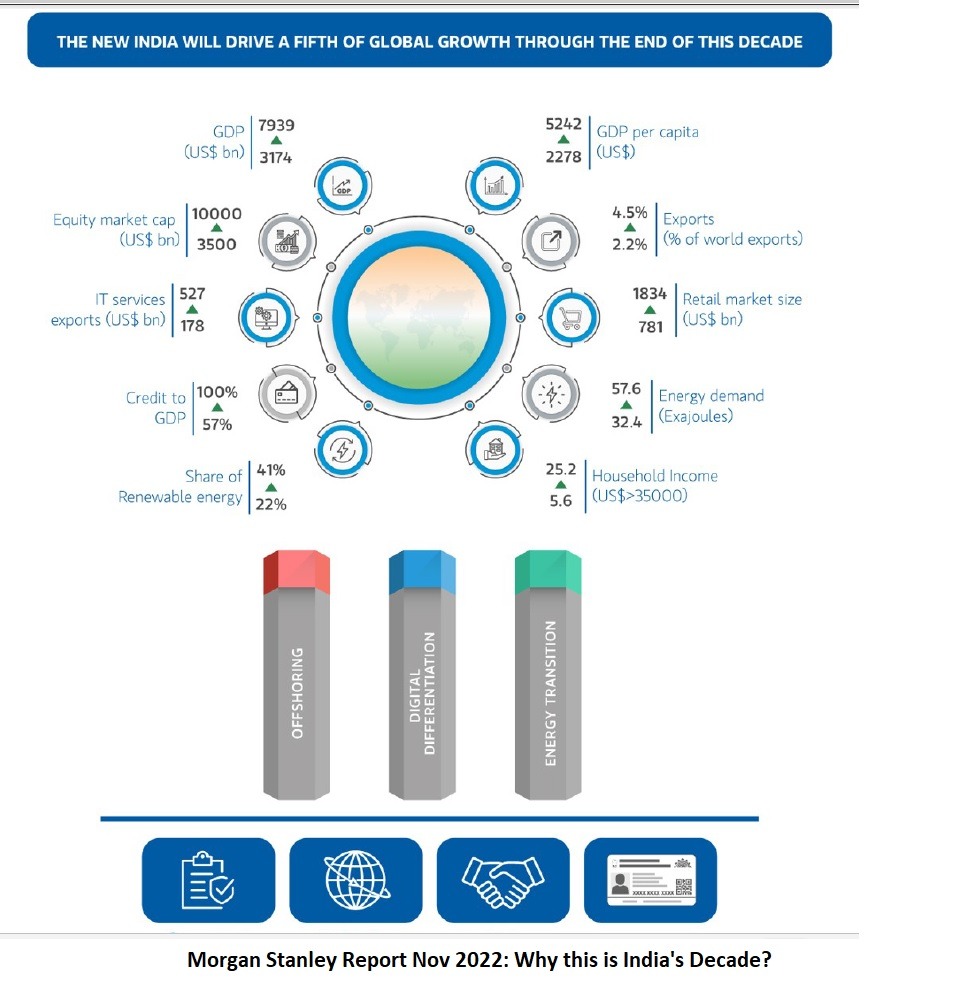

Morgan Stanley India – Why is this India’s Decade?

Those of you who have been talking to me regularly may recall our conversations wherein I keep mentioning how bullish I am on India for investments and that we should not miss this decade for investing. I am happy to share that these views are also corroborated by Morgan Stanley India’s Research Desk. Given below are the key highlights of the study by Morgan Stanley “Why This is India’s Decade” released on 31st October, 2022.

Despite the Global turmoil, India’s markets are nearly at an all-time high. We should be reaping the benefits of the future rally expected. It would be advisable to continue to invest in Equity, not as a lumpsum but through SIPs and STPs.

India’s GDP is likely to surpass US$7.5 trn by 2031, more than double current levels, making it the third-largest economy and adding about US$500 bn per annum on an incremental basis over the decade. |

India’s market capitalization will likely grow by over 11% annually, to US$10 trn, in the coming decade. |

We estimate that manufacturing’s share of GDP will rise to 21% by 2031, implying an incremental U$1 trn manufacturing opportunity. |

We expect India’s global export market share to more than double to 4.5% by 2031, providing an incremental US$1.2 trn export opportunity. |

India’s services exports will almost treble to US$527 bn (from US$178 bn in 2021) over the next decade. |

The study also indicates that in the post-Covid environment, global CEOs appear more comfortable with both working from home and working from India. The emergence of distributed delivery models, along with tighter labor markets globally, has accelerated outsourcing to India. |

Regulatory Changes

The year 2022 has witnessed lots of regulatory changes. Mobile and e-mail verification has been introduced to ensure that they do belong to the investor. The nominee authentication and subsequently, changes in KYC norms indicate that SEBI is as ever taking stringent measures to ensure investor protection. I am sure this will help a long way for the investors to get more confidence into mutual fund investments and I do consider this to be a step in the right direction for the welfare of the industry. I am thankful to all my clients for their understanding and helping with the compliance.

Global Updates

This year gone by, marked a rollback as the world moved back to a New Normal post-Corona.

There has been a turmoil in the markets globally this year, which is reflected in higher interest rates and inflation globally. Markets fell significantly in most markets. India has been able to hold on very well. Domestic SIP flows in India hit a record last month at Rs 13,000 crore a month.

Stress between Russia & Ukraine continues and the war which was expected to end shortly continues for the past 10 months. As a result, fuel prices have hiked which has impacted forex reserves for the country. To protect the reserves, RBI had taken a decision in Feb 2022, to disallow inflows into international mutual funds. Unfortunately, the restriction still continues, else this would have been a good time to take advantage of investing in the U.S. markets which are under pressure and facing the heat.

Processes within Financial Radiance

I am happy to share that my Assets Under Management (AUM) is fast approaching Rs 100 Crores and I am likely to achieve this milestone by the next financial year. SIP booked by me currently is about Rs 85 lakhs a month. After the AUM touches the figure, I would be subject to audit by Association of Mutual Funds in India (AMFI). Processes followed by AMFI for all mutual fund intermediaries are already very watertight, but if there are still any gaps, these are identified in such audits, and therefore, this milestone provides an impetus to me to strengthen the practice further.

To ensure the continuity of business and not to make it person dependent, I have been working towards setting up a partnership firm. I am also in the process of evaluating other reporting softwares to assess if more value can be provided to clients.

This year, I have successfully digitized Back-end processes as well. You may be aware that the front end investing was digitized right from the beginning of the practice in 2016. My office is completely paperless, which has helped me immensely in working with Clients all over the Globe. With the backend also digitized, this is expected to offer me a lot of advantages. Future expansion of the practice, as and when needed, can be done very easily. I can hire the resources from anywhere, work can be done from any location and physical presence in my office is no longer needed. I would still continue to get the dashboards on my intranet sitting in my office.

Helping hand @ Financial Radiance

Speaking of additional resources, I am happy to inform you that my wife, Lalita, who is a Mass communications professional, joined the practice on a freelancing basis this year. She has managed corporate communications, digital media marketing, and Social media for many organizations in the past. To begin with, she started with managing social media for Financial Radiance. Subsequently, she has taken and qualified the NISM exam too! Only professionals who qualify this exam are allowed to recommend and manage mutual funds for Clients.

Personal milestones

In my last year’s blog, I had mentioned that after spending 21 years in South India, we made a decision to relocate to Greater Noida due to personal reasons. Since I manage investments digitally for my clients there was no impact on the business. I am now happy to share another milestone. We have moved to a new location within Greater Noida, into our New home, wherein I now have a dedicated office space for myself.

Vision for My Clients

On my 6th Work Anniversary, I have developed a vision for my Clients. During the course of my entire practice, I would like to build 50 dollar millionaires and 200 Crorepatis (Rupee denominated). I am very confident that this would be achievable with the continued support from everyone and with the focus on continuing to believe in India’s growth story, for this decade and beyond ……

Before,I sign-off for now, a few things:

Personal Finance Toolkit – I created this toolkit which is available free to download. Using this toolkit would help in determining the net worth and the various documentation relating to personal finance in one single place. Do download it and let me know your feedback.

Link to previous year’s perspectives – I have been writing my perspectives on completing every year at Financial Radiance. Do read them in your leisure. I am sure you will enjoy them as much as I do while working for Financial Radiance.

Blogs on Personal Finance – I have written quite a few blogs on various diverse personal finance topics. Please do have a look and provide your comments.

- Youtube Channel – Please watch my youtube channel and subscribe.

Until next year, bye from me, and I shall be back with my perspective on completing 7 years at Financial Radiance.