Why power of compounding is 8th Wonder of the World!

Many investors wonder how mutual funds returns are achieved, and how the power of compounding in mutual funds plays a major role. When discussing mutual funds, the primary consideration is often the potential for returns over the long term. To explore this concept further, let us start with a story. In a busy city, Alex […]

Start Small, Grow Big: 4 Concepts on how Early Investing can make a Difference!

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages. Why should it be any different for investing? One popular way of building Wealth over a long period of […]

How Much Is Enough Money For You?

It’s easy to get caught up in the rat race and forget to enjoy life. However, it is important to consider, how much money is enough for you? How much money do you need to be happy? to comfortably retire? to have a good life? According to a survey by Bankrate.com, nearly half of […]

Financial Radiance completes 4 years – A perspective

Financial Radiance completes 4 years – A perspective 2020 would be a year that would not be easily forgotten by anyone. The year would be known for the pandemic – Covid 19 which spread all over the World. Enough has been written about it in the media, so I will not focus on it. In […]

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip I have spoken in the past about why all of us should take maximum tax rebates by investing in appropriate tax-saving products. Money saved is money earned and, in this case, it is not just the money which is invested for tax benefits, but […]

12 tips to identify best mutual funds for investing

Best mutual funds to invest? 12 analysis tips If you are new to Mutual Funds, then you may first want to read my previous blog on Mutual Funds Categories. Searching for the best Mutual Funds for investment?: 12 points to look for (and not overlook!) Chasing the best mutual funds for investing? Don’t judge […]

Do Mutual Fund categories still scare you?

Do Mutual Fund categories still scare you? Retirement planning as a concept has been picking up in the recent past. The terminology has changed though. Retirement is generally seen as connected to old-age when we think about it which we want to avoid. So, there is a new word now which is used in conjunction, […]

Anticipating Job loss? 6 Actions Items Before and After!

Anticipating Job loss? 6 Actions Items Before and After! Current situation We are going through unprecedented times like never before with the Covid-19 situation and the news about job losses. Unlike the influenza flu which had happened in Spain a century ago, this time it is different. The impact of Covid is Global. India took […]

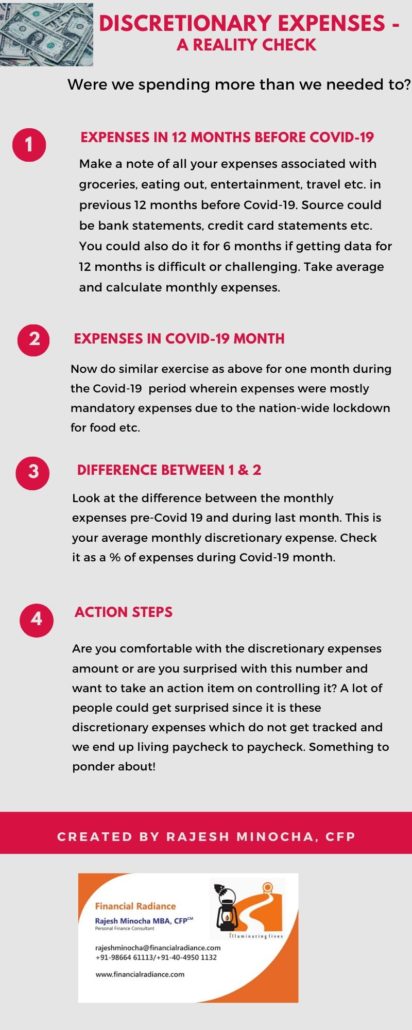

Discretionary expenses – A Reality check

Discretionary expenses– A Reality check Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

What is KYC (Know your Customer) – Times of India – 19Jan2020

Times of India – 19Jan2020 – Know Your Customer (KYC) Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

3 Years helping clients achieve financial goals

3 Years helping clients achieve financial goals I completed yet another vibrant year, my third at Financial Radiance on 1st December, 2019. The mission I started in 2016, with the vision of helping my clients globally achive financial freedom. While I had described my second year as a roller coaster ride, this year was with even […]

What are SIP myths? Here are 7 of them that are busted

What are SIP myths? Here are 7 of them that are busted Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is a blog originally written by Chalo Niveshak on this topic. This blog is written to clarify the myths around Systematic Investment Plan […]

GuruSpeak post in Mint newspaper dated 2nd Sep 2019

How soon should start investing for your retirement? GuruSpeak post in Mint newspaper dated 2nd Sep 2019 Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

16 simple ideas to start wealth creation and build net worth

Wealth Creation – Building Net Worth step by step, simplified Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is a blog originally written by Chalo Niveshak on this topic. This blog provides very simple steps which we can take towards wealth creation. I have […]

Personalized financial advice: 6 reasons why it is different

Why is financial advice personalized? Last week, I had written a blog on why we need a financial planner. This week, it is a follow-up on the same topic wherein I present my thoughts on why financial advice is personalized and why one size does not fit all. Financial illiteracy in schools and colleges: This […]

Why do I need Financial Planner when I know how to invest

Why do we need a Financial Planner? This is a very sensitive and a commonly discussed topic amongst personal finance groups. What is the value of what a financial planner or the financial advisor or the financial coach (whatever name they are called), brings to the table. I would like to put some of my […]

Financial Stress: Try the 7 ways in which it can be reduced

Financial Stress – Is it that bad? What is Financial stress? When you keep thinking about money (or the lack of it) even when you are doing an activity which you enjoy. One study concludes that financial stress can increase risk of heart attack by 13% and therefore it is critical for everyone to work […]

What is Reverse Mortgage loan – An option for retirees?

Reverse Mortgage Loan – An Option for Retirees? Reverse Mortgage Loan – This is useful for the retirees who have not planned enough for retirement and are in need of cashflow for their regular expenses. We willl get into details on this later. I have written numerous articles on retirement planning and why it is […]

What is a Trust and how is it different from a Will

Basics of Trusts In my previous write-up writing a Will, I mentioned that this should be one of the most important activity on the to-do list for all but is unfortunately neglected by a lot of people. Hope you have read the article, and if not, I encourage you to read it. This write-up in […]

How to write a Will? Is it necessary and what should it contain?

Writing A Will – is it necessary In my interactions with few people, I have heard a lot of questions about the need of Will and the lack of awareness of the same. So, this week, I decided to prepare a write up on such an important topic of Estate Planning. Some questions which come […]