Financial Radiance completes 7 years!

This is that time of the year, 1st of December every year, when I reach out on my work anniversary. I share my perspectives on the year gone by, hits and misses, updates and the learnings during the year. It is very hard to believe that seven years have passed since I started this practice […]

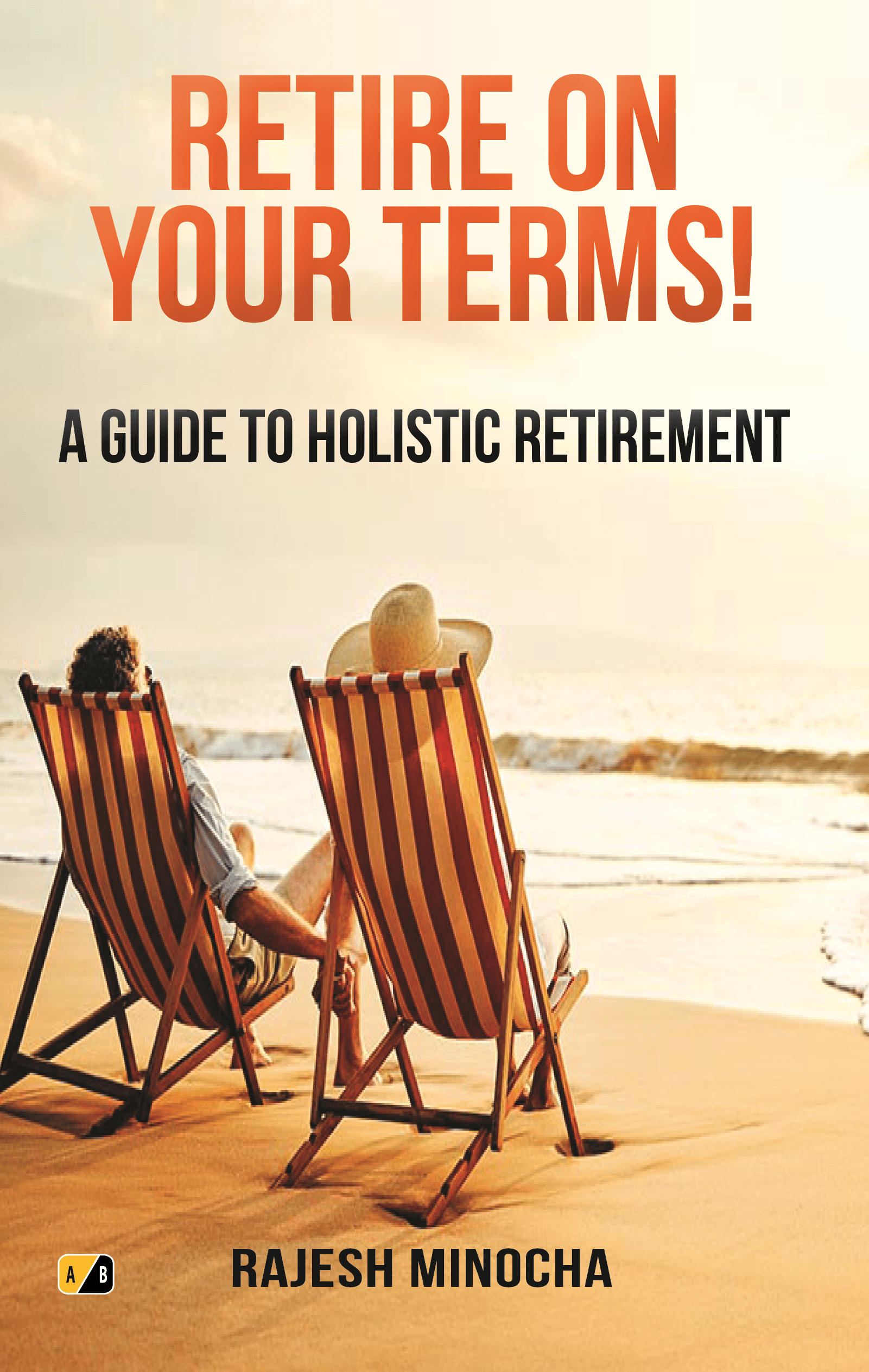

Retire on your terms: A Guide to Holistic Retirement

Retire how you want, not how others want you to! Have you been struggling to maintain a work-life balance? Are you working just to pay your bills? Is your job aligned with your passion? Are you striving for financial freedom? Retirement can be an exciting time, but it can also be overwhelming if you’re […]

Start Small, Grow Big: 4 Concepts on how Early Investing can make a Difference!

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages. Why should it be any different for investing? One popular way of building Wealth over a long period of […]

Financial Radiance completes 6 glorious years – A perspective

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2022, I am happy to share that […]

7 ‘Wants’ management tips for Effective financial health

7 ‘Wants’ management tips for Effective financial health “If you buy things you DO NOT NEED, soon you will have to sell things that you NEED” – Warren Buffett It is possible to categorize all of our expenses and spending activities into two categories: “necessities” and “wants” for effective financial planning. When you spend […]

Financial Radiance completes 5 years – A perspective

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2021, I am happy to share that […]

12 tips to identify best mutual funds for investing

Best mutual funds to invest? 12 analysis tips If you are new to Mutual Funds, then you may first want to read my previous blog on Mutual Funds Categories. Searching for the best Mutual Funds for investment?: 12 points to look for (and not overlook!) Chasing the best mutual funds for investing? Don’t judge […]

Do Mutual Fund categories still scare you?

Do Mutual Fund categories still scare you? Retirement planning as a concept has been picking up in the recent past. The terminology has changed though. Retirement is generally seen as connected to old-age when we think about it which we want to avoid. So, there is a new word now which is used in conjunction, […]

What are SIP myths? Here are 7 of them that are busted

What are SIP myths? Here are 7 of them that are busted Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is a blog originally written by Chalo Niveshak on this topic. This blog is written to clarify the myths around Systematic Investment Plan […]

16 simple ideas to start wealth creation and build net worth

Wealth Creation – Building Net Worth step by step, simplified Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is a blog originally written by Chalo Niveshak on this topic. This blog provides very simple steps which we can take towards wealth creation. I have […]

Personalized financial advice: 6 reasons why it is different

Why is financial advice personalized? Last week, I had written a blog on why we need a financial planner. This week, it is a follow-up on the same topic wherein I present my thoughts on why financial advice is personalized and why one size does not fit all. Financial illiteracy in schools and colleges: This […]

Why do I need Financial Planner when I know how to invest

Why do we need a Financial Planner? This is a very sensitive and a commonly discussed topic amongst personal finance groups. What is the value of what a financial planner or the financial advisor or the financial coach (whatever name they are called), brings to the table. I would like to put some of my […]

Financial Stress: Try the 7 ways in which it can be reduced

Financial Stress – Is it that bad? What is Financial stress? When you keep thinking about money (or the lack of it) even when you are doing an activity which you enjoy. One study concludes that financial stress can increase risk of heart attack by 13% and therefore it is critical for everyone to work […]

What is Reverse Mortgage loan – An option for retirees?

Reverse Mortgage Loan – An Option for Retirees? Reverse Mortgage Loan – This is useful for the retirees who have not planned enough for retirement and are in need of cashflow for their regular expenses. We willl get into details on this later. I have written numerous articles on retirement planning and why it is […]

What is MWPA and why we should endorse in life insurance?

Married Women’s Property Act (MWPA) – Why you need to know? In my previous write-up Life Insurance – What to look for? I introduced a term called MWPA and mentioned that it needs a separate section. So, here it is …. What is MWPA? MWPA stands for Married Women’s Property Act. Under this act enacted […]

Don’t buy life insurance without reading this – 11 critical points

Life Insurance – What to look for? page In today’s uncertainty of life, planning for various goals and knowing how much is needed, considering inflationary aspect is extremely vital and therefore it is important not to neglect this aspect of life insurance in personal financial planning. Many a time, people are underinsured or simply not […]