Why power of compounding is 8th Wonder of the World!

Many investors wonder how mutual funds returns are achieved, and how the power of compounding in mutual funds plays a major role. When discussing mutual funds, the primary consideration is often the potential for returns over the long term. To explore this concept further, let us start with a story. In a busy city, Alex […]

Start Small, Grow Big: 4 Concepts on how Early Investing can make a Difference!

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages. Why should it be any different for investing? One popular way of building Wealth over a long period of […]

7 ‘Wants’ management tips for Effective financial health

7 ‘Wants’ management tips for Effective financial health “If you buy things you DO NOT NEED, soon you will have to sell things that you NEED” – Warren Buffett It is possible to categorize all of our expenses and spending activities into two categories: “necessities” and “wants” for effective financial planning. When you spend […]

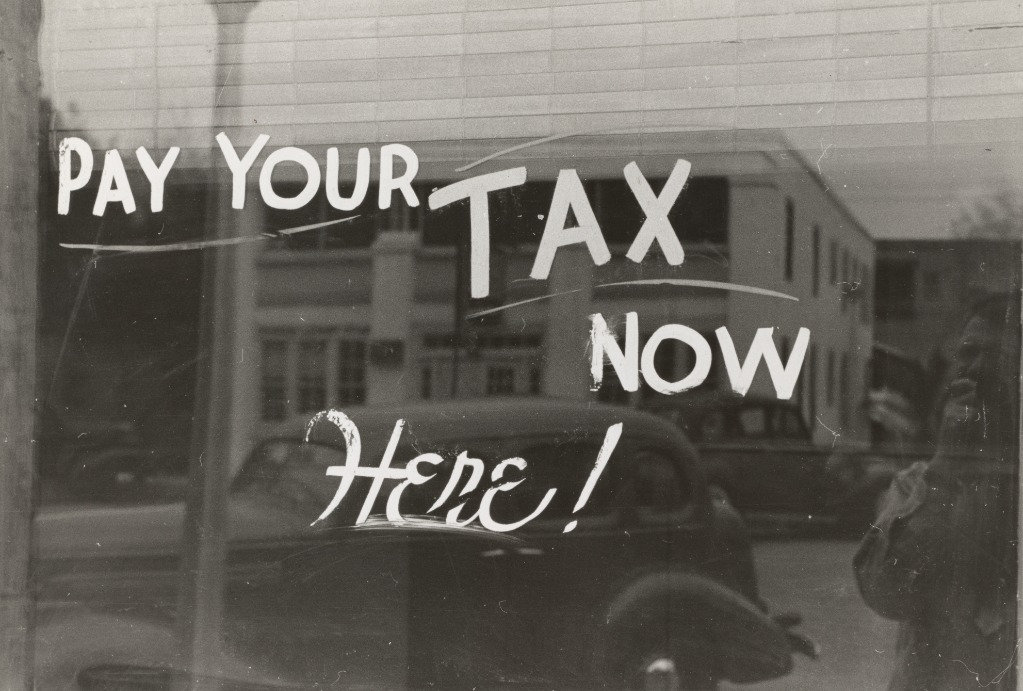

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip I have spoken in the past about why all of us should take maximum tax rebates by investing in appropriate tax-saving products. Money saved is money earned and, in this case, it is not just the money which is invested for tax benefits, but […]

12 tips to identify best mutual funds for investing

Best mutual funds to invest? 12 analysis tips If you are new to Mutual Funds, then you may first want to read my previous blog on Mutual Funds Categories. Searching for the best Mutual Funds for investment?: 12 points to look for (and not overlook!) Chasing the best mutual funds for investing? Don’t judge […]

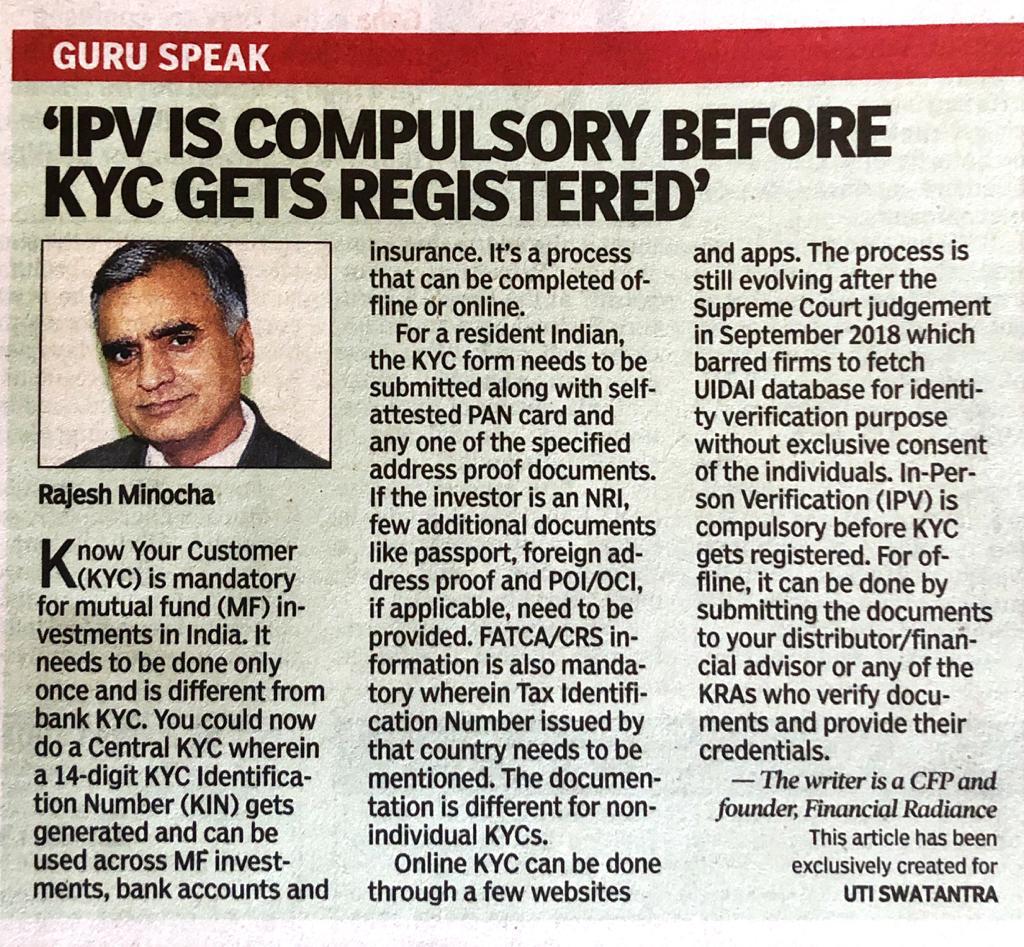

What is KYC (Know your Customer) – Times of India – 19Jan2020

Times of India – 19Jan2020 – Know Your Customer (KYC) Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

GuruSpeak post in Mint newspaper dated 2nd Sep 2019

How soon should start investing for your retirement? GuruSpeak post in Mint newspaper dated 2nd Sep 2019 Share Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Share on whatsapp WhatsApp

16 simple ideas to start wealth creation and build net worth

Wealth Creation – Building Net Worth step by step, simplified Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is a blog originally written by Chalo Niveshak on this topic. This blog provides very simple steps which we can take towards wealth creation. I have […]

11 advantages ELSS offers against other 80C tax saving products

ELSS for Tax Savings – Section 80C When I meet my clients, one question which I often get asked is “I pay lot of taxes every month. How can I save taxes legitimately?” Financial Radiance is proud to be associated with Chalo Niveshak initiative – one nation one brand for financial advisors. Given below is […]