Active vs. Passive: Want to know what style is good for you?

When investing in the financial markets, one crucial decision we all need to make is choosing between active and passive management funds. Understanding the differences between these two approaches is essential for making informed investment decisions. Let’s explore and understand the characteristics and importance of choosing between active and passive management funds, which helps […]

Why power of compounding is 8th Wonder of the World!

Many investors wonder how mutual funds returns are achieved, and how the power of compounding in mutual funds plays a major role. When discussing mutual funds, the primary consideration is often the potential for returns over the long term. To explore this concept further, let us start with a story. In a busy city, Alex […]

Financial Radiance completes 7 years!

This is that time of the year, 1st of December every year, when I reach out on my work anniversary. I share my perspectives on the year gone by, hits and misses, updates and the learnings during the year. It is very hard to believe that seven years have passed since I started this practice […]

Retire on your terms: A Guide to Holistic Retirement

Retire how you want, not how others want you to! Have you been struggling to maintain a work-life balance? Are you working just to pay your bills? Is your job aligned with your passion? Are you striving for financial freedom? Retirement can be an exciting time, but it can also be overwhelming if you’re […]

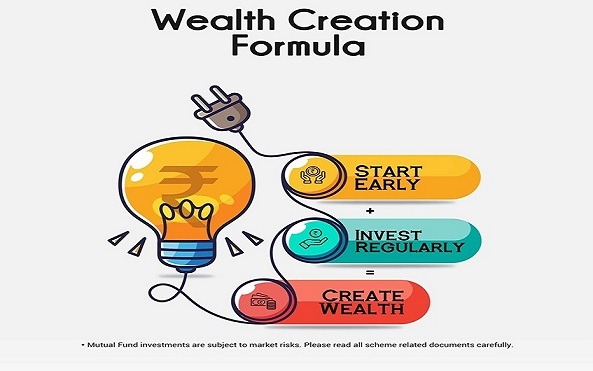

Start Small, Grow Big: 4 Concepts on how Early Investing can make a Difference!

Introduction According to a popular saying, being early to bed and rise makes one healthy, wealthy and wise. But it’s not just waking up early that’s good; in many aspects, being early has its own advantages. Why should it be any different for investing? One popular way of building Wealth over a long period of […]

How Much Is Enough Money For You?

It’s easy to get caught up in the rat race and forget to enjoy life. However, it is important to consider, how much money is enough for you? How much money do you need to be happy? to comfortably retire? to have a good life? According to a survey by Bankrate.com, nearly half of […]

Financial Radiance completes 6 glorious years – A perspective

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2022, I am happy to share that […]

3 Incredibly simple ways to get a high-quality health insurance plan

Yes, It is possible to get low-cost, high-quality health insurance plans. This blog is dedicated to guide you on this.

Some people have spent a significant amount of money on extremely expensive high-coverage health insurance. You can still obtain the same level of protection for a fraction of the price. Let’s take it step by step to understand it.

7 ‘Wants’ management tips for Effective financial health

7 ‘Wants’ management tips for Effective financial health “If you buy things you DO NOT NEED, soon you will have to sell things that you NEED” – Warren Buffett It is possible to categorize all of our expenses and spending activities into two categories: “necessities” and “wants” for effective financial planning. When you spend […]

Financial Radiance completes 5 years – A perspective

Those of you who have been reading my blogs regularly must be expecting this blog that I am writing. I share my perspective every year, talking about how the year has been, my share of hits and misses, learnings, and my perspective for the future. On December 1, 2021, I am happy to share that […]

Financial Radiance completes 4 years – A perspective

Financial Radiance completes 4 years – A perspective 2020 would be a year that would not be easily forgotten by anyone. The year would be known for the pandemic – Covid 19 which spread all over the World. Enough has been written about it in the media, so I will not focus on it. In […]

Don’t default on credit card bill – 10 smart options to consider

Don’t default on credit card bill – 10 smart options to consider I have covered previously on the topic of credit cards. I provided 17 tips to manage credit cards effectively. I have also written about debt traps in the past and also about how can we not live a life paycheck to paycheck. The […]

5 Reasons why too much money in bank is bad and what you should do

5 Reasons why too much money in bank is bad and what you should do This is an important topic for discussion and therefore I decided to dedicate a separate blog for it. According to me, this is one of the biggest mistakes done by a lot of people wherein they just let the money […]

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip

ELSS vs PPF: 7 critical decision-making features PLUS a bonus tip I have spoken in the past about why all of us should take maximum tax rebates by investing in appropriate tax-saving products. Money saved is money earned and, in this case, it is not just the money which is invested for tax benefits, but […]

What is loan closing and why you should do this properly?

What is loan closing and why you should do this properly? In my previous blogs, I have mentioned about how banks determine the loan eligibility, the factors they consider, and how we can increase the loan eligibility. Now let’s fast forward, assume that you have been regular in making the EMI payments and finally the […]

6 tips to increase Home loan eligibility

6 tips to increase Home loan eligibility In my previous blog, I mentioned how loan eligibility is calculated and what are the factors which are looked into before a bank decides to sanction a loan to you. You may need a higher loan than the bank is willing to provide, so how your loan can […]

Loan Eligibility – Know why Bank could sanction lower loan to you

Loan Eligibility – Know why Bank could sanction lower loan to you This could be your first time when you are buying a property and are very excited. You decide that you have enough money for the down payment, you go to the bank to take a loan and then you get a shock that […]

NRI Investors – Should you invest in India – why and how?

NRI Investors – Should you invest in India – why and how? In one of my previous blogs, I provided basic definitions of who is a Non-Resident Indian (NRI), Resident & Not Ordinary Resident (RNOR), Resident Indian (RI), Person of Indian Origin (PIO), and Overseas Citizenship of India (OCI). I also mentioned about differences in NRI […]

Reasons for loan rejection and 4 action steps to be taken

Rejected loan application? Here are 4 action steps Most of the investors take some kind of loan and when they are not able to pay the EMIs on time or default on the loan, their CIBIL report gets messed up and they don’t get further loans in future. Have you ever had a rejected loan […]

Are you making any of these 7 Investment mistakes?

Are you making any of these 7 Investment mistakes? Some investors invest directly in stock markets or through mutual funds, make wrong decisions, suffer huge losses and then start blaming the markets, quit them for good, and go extremely conservative by keeping the money in Fixed Deposits or worse, in Savings Bank. This in my […]