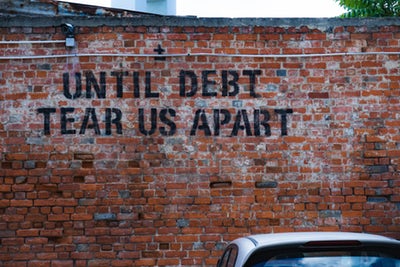

More and more people are falling into debt trap now. Many people are frequently seeking the help of professionals who can get them out of the debt trap. Whether we switch on the television, read the newspaper or surf the internet, someone somewhere is always selling something to us and vying to get our attention. It is so easy now to fall into the debt trap and therefore we should acknowledge the early warning signals and take necessary actions before it becomes too late if we do fall into this trap. Living a life paycheck to paycheck could mean a delay in achieving financial freedom.

Wikipedia defines a debt trap as a situation in which a debt is difficult or impossible to repay, typically because high-interest payments prevent repayment of the principal.

Consumerisms and aspirations beyond means are significant causes of falling into a debt trap. What we see as a smart financial decision initially could turn out to be an illusion. There could be an urge to go one-up on our lifestyle when we compare it with our neighbours, relatives or our friends. Social media and the easy availability of credit further gets us closer to the debt trap. It is almost like falling into a swamp. Easier to fall, but very difficult to come out of it!

As it happens with our own body, which gives early warning signals of getting into health issues if not taken care, the same happens with our financial life too. We do get early warning signals. It is up to us to detect them to acknowledge and then take suitable action. So, what are some of such signals?

1. EMI as % of take-home salary

As a thumb rule, this should never exceed 50%. We do need to acknowledge that even if our regular expenses (discretionary and non-discretionary) are less than 50% of our take home salary, still there will always be situations where there will be unexpected expenses or school fees payment, travel, etc. So, we should strive to keep all our EMIs (home loan, personal loan, automobile loan) lower than this limit. Remember, there would be credit card payment to be paid every month too. Intentionally, I have not included it under types of EMIs, since this should always be paid in full.

2. Credit card payments

Speaking of credit cards, we need to first check if we are using them properly and if not then correct our behaviour. As mentioned, previously, they should be paid in full, as even if there is a small outstanding, we do not get any interest free credit. The interest charges, late payment fees, ATM withdrawal fees (should never be done), etc all add up very quickly. Credit card is a great and convenient way of managing our finances, but if you think it gets you out of control and you are not able to resist your temptation of buying all the “Wants”, then feel free to cut the credit card and instead start using Debit card. Your credit score can get severely impacted if the credit card is not used properly. I have written a blog on credit score previously which you may want to read.

3. Stop receiving calls from Banks for loans

We get so irritated when we get such unwanted calls and then we start registering into Do-Not-Call Registry. Don’t we? But, if we do not get any calls from the Banks for any loans, then this could also be an early warning signal! Basically, banks would like to give loans only to those who have a good credit score and therefore would most likely get their money back along with interest. Ironically, in a lot of cases, these people may not really need the loans and those who need the loan aren’t creditworthy and therefore banks are not interested in giving them money. This is ironical but is true.

4. When you start rationalizing with yourself

If you find yourself justifying yourself after the expenses have been incurred. As an example, say you buy a luxury car on a vehicle loan and later when you make the EMI payments, you find it difficult to make the payments, but then rationalize and think that I really needed it, but was not hasty, on the spot decision. You keep thinking that if others can have good things in life, can drive a new car, live happily, why not you? This could become a bigger issue in future not just remaining with the car, but also other luxuries when there are more comparisons with others. Slowly, the wants would become needed and the eventual failure in the end, if you cash flows don’t allow and you continue with the spending spree.

Certain types of loans like house loan and education loan (to some extent) are good loans and could be availed. But, when and how much you should be taking such loans depends a lot on your personal circumstances and situations. Therefore, you should discuss with your financial advisor and should jointly determine what is best for you.

This also depends on case to case basis and therefore cannot be generalized. However, do note that in any EMI, the interest component would be very high initially which keep decreasing as the tenure increase and then the principal component within the EMI goes up. Also, there are certain investments like an Equity Linked Saving Scheme (ELSS) or life insurance premiums which could get you tax benefits. Therefore, it is best that you discuss your cash flows with your financial planner and then determine the best course of action.

Let me be honest, it is very difficult, but not impossible if you have a strong desire and willingness to set your financial life on the current path. You would notice that the same banker who had coaxed you with sweet talks starts behaving very differently. The cheaper loans access which you once had suddenly become expensive after default and a fall in credit rating. There are agencies which can help you in coming out of the debt trap and may be worth visiting. In a nutshell, the key steps to be taken are: getting rid of high-cost loans first (ex. credit card outstanding), approaching family members, well-wishers, relatives for help, leveraging your assets – taking up loans against them to pay off expensive loans, etc. This would only be a short-term solution. The long-term solution would be to consider it as a learning and never fall into it again!

So, does that mean that we control all our urges and do not have aspirations to lead a luxurious life? The response to this would vary depending on your outlook to life. You could be a proponent of minimalism (if you want to know more about it, then here are some minimalism books) or you could be a connoisseur wanting to enjoy all the luxuries in life. Whatever approach we take, we just need to ensure that we do not fall into the debt trap. As always, it would be great to get your perspective in the comments section, or if there is anything you would like to discuss, then please feel free to contact me. You can also read my other blogs on personal finance at my website www.financialradiance.com.